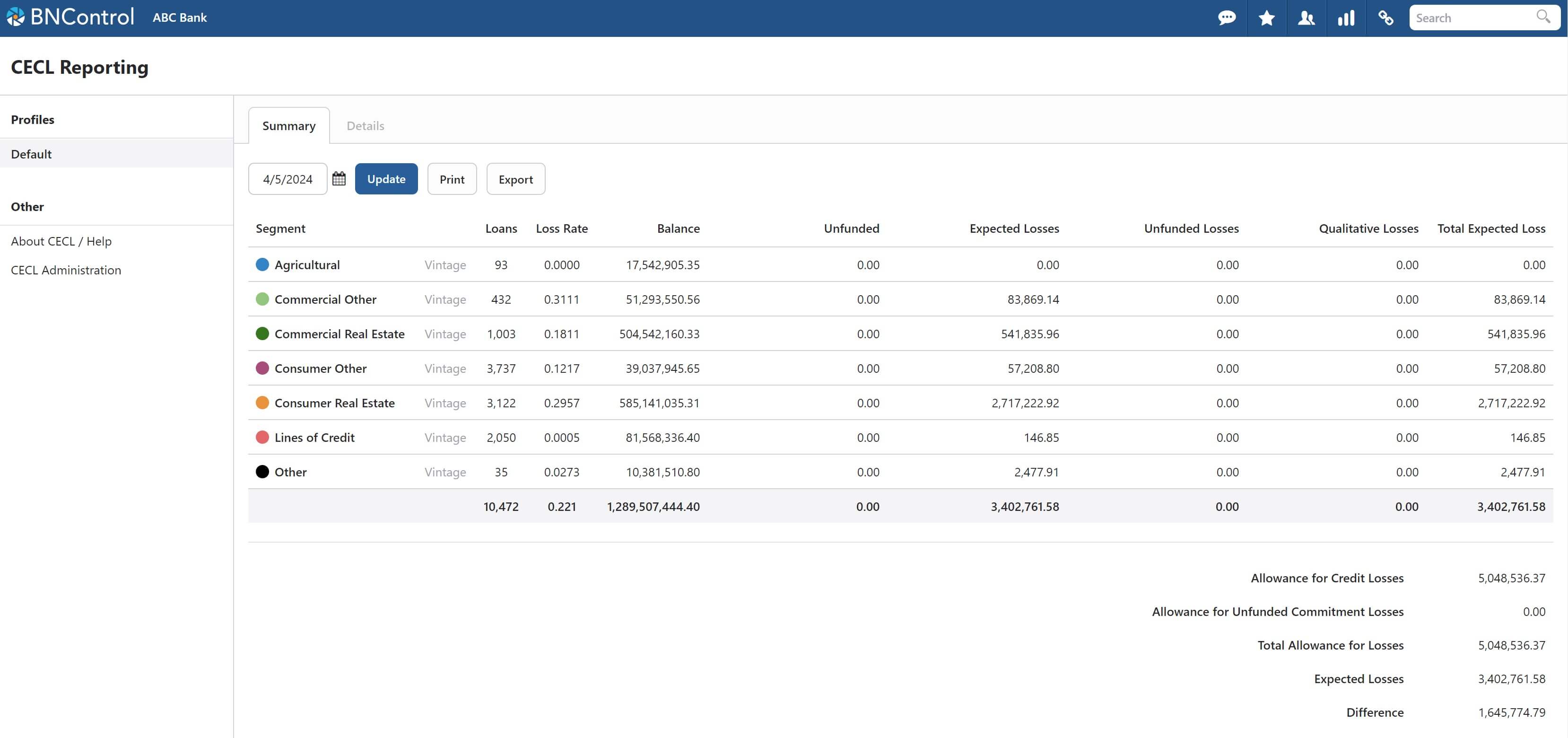

CECL

Confidence in allowance for loan losses.

Transform a complex process into a straightforward framework for estimating loan losses.

Getting Started

Getting started with the CECL module is straightforward. When you create a new profile, define how you want to group your portfolio, by product or call code. Once you have chosen a grouping method, you can start creating your segments. With each segment, we provide a brief overview of the accounts, total balance, average term, and a variety of loss methodologies including Vintage, PDxLGD, Loss Rate, and Migration.

- Multiple profiles and segments

- Vintage methodology

- PDxLGD methodology

- Loss Rate methodology

- Migration methodology

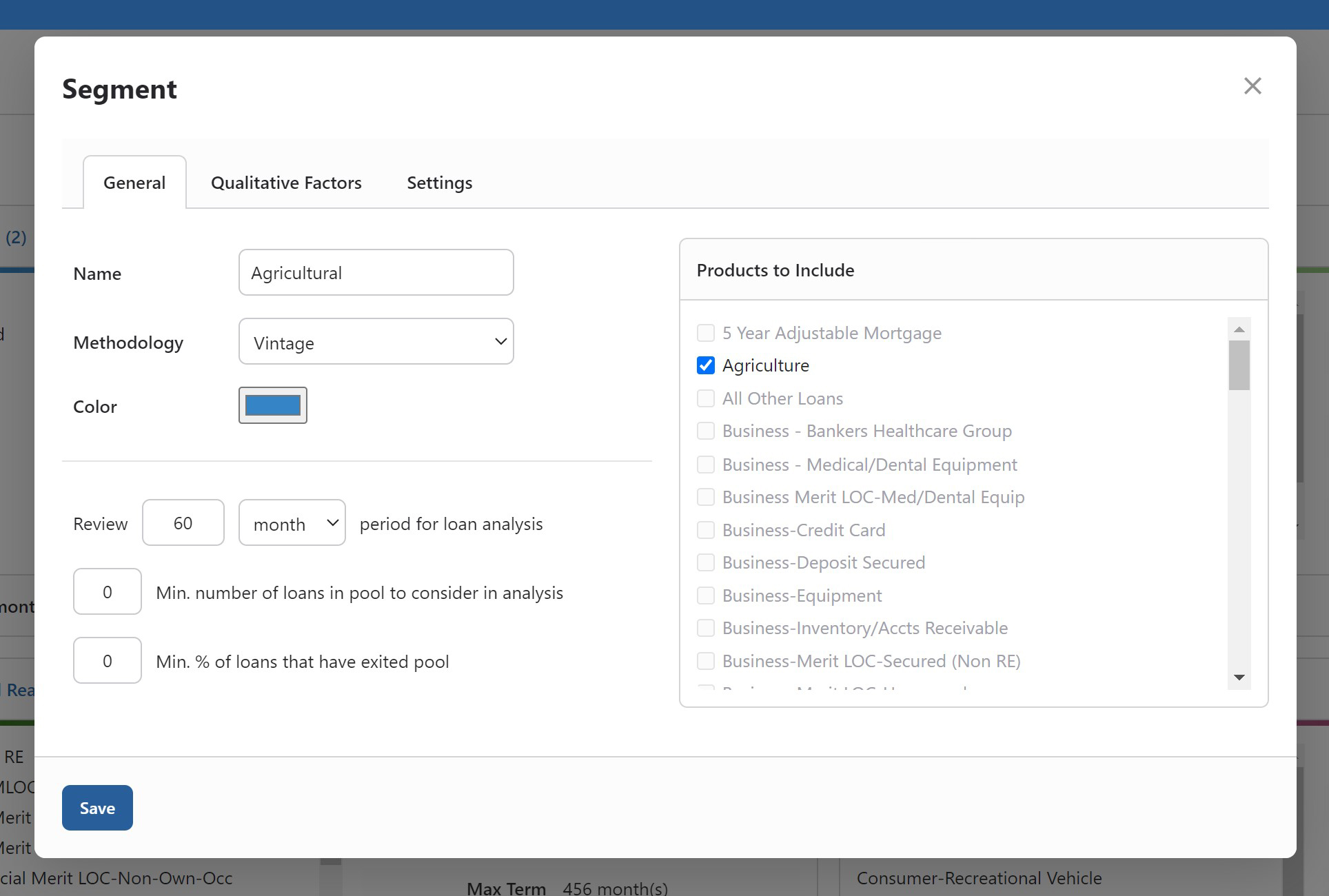

Profiles

Multiple CECL profiles allow you to create any number of different scenarios to see what best fits your portfolio and needs. For example, you could create a profile that assumes a high level of economic uncertainty, or one that assumes a low level of economic uncertainty. You could also create a profile that assumes a specific industry or sector is likely to experience more losses than others. By creating multiple profiles, you can get a better understanding of how different factors could impact your CECL estimates. This information can be used to make more informed decisions about your portfolio and risk management.

- Multiple profiles

- Group by product or call code

- Custom qualitative factors

- Custom review periods

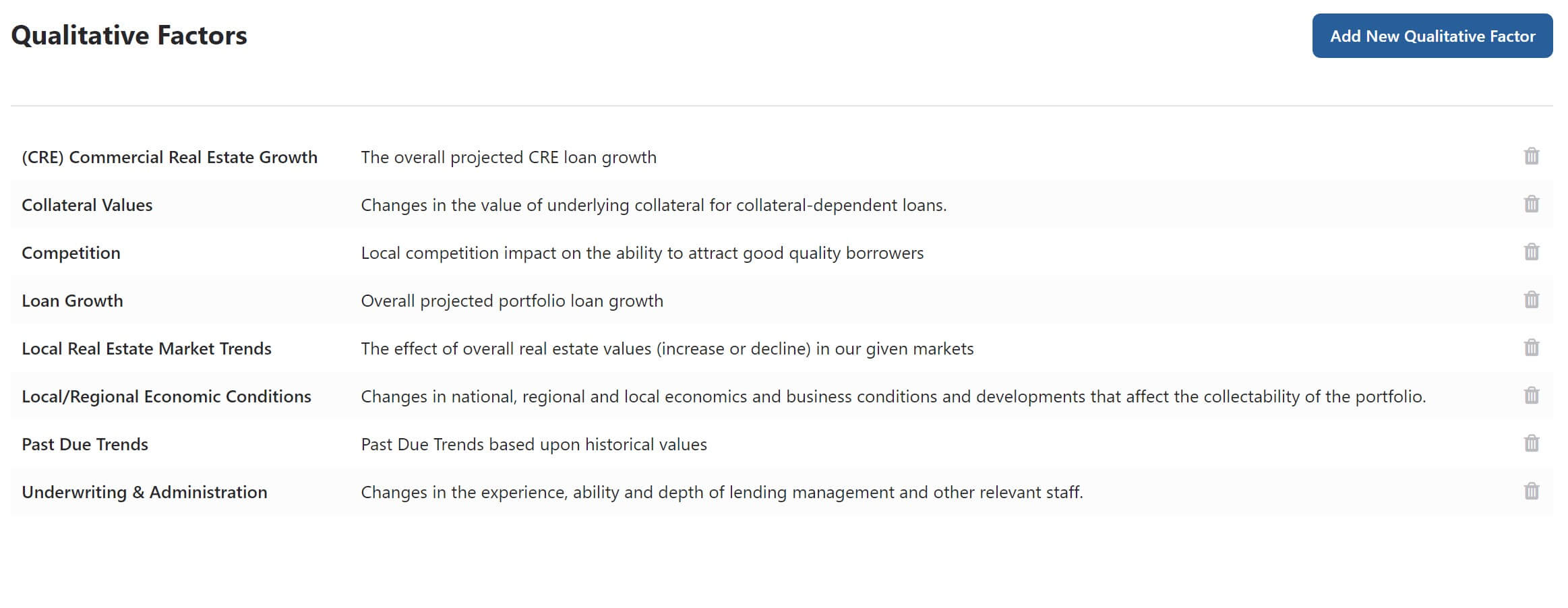

Qualitative Factors

CECL qualitative factors allow for adjustments to be made for various reasons, such as collateral values, loan growth, real estate trends, regional economic conditions, past due trends, and more. These factors can be applied at a granular, segment level by specific date ranges or at an overall profile level that would be applied to all segments.

Are you ready for a demo?

There's nothing like seeing it for yourself and we're excited to show you how BNControl can benefit your organization in so many ways.