Compliance

Let us do the heavy lifting.

All the data you need to manage your BSA program, combined and ready to go.

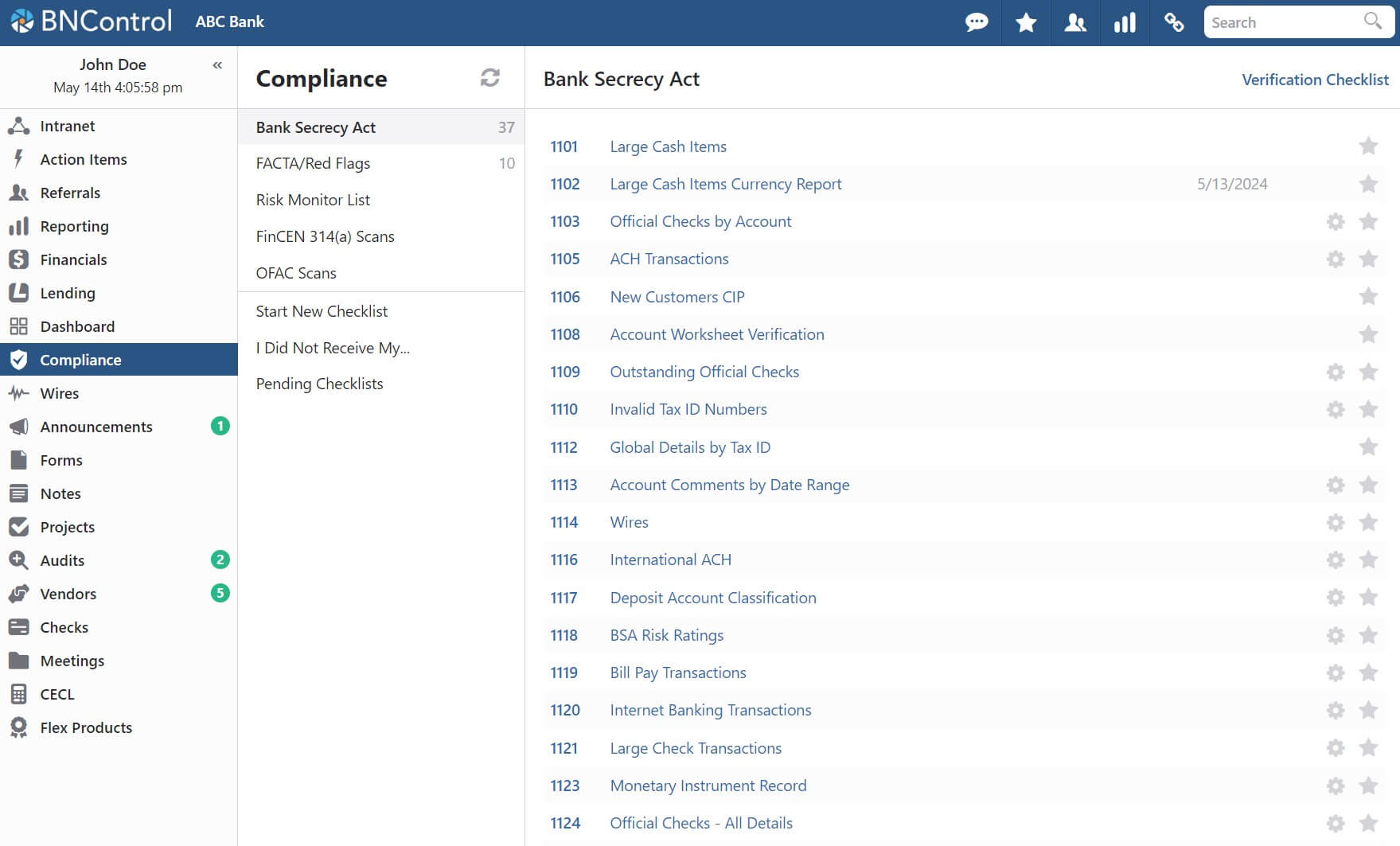

Bank Secrecy Act

Our BSA solution provides a comprehensive framework to help you comply with regulations by streamlining the information collection and monitoring process. Our compliance reports give you easy access to reports on large cash items, suspect kiting and floating, suspect client-owned ATMs, employee accounts, cryptocurrency transactions, elder abuse exploitation, and more.

- Large cash items

- Elderly financial exploitation

- Suspect client-owned ATMs

- Cryptocurrency transactions

- Employee accounts

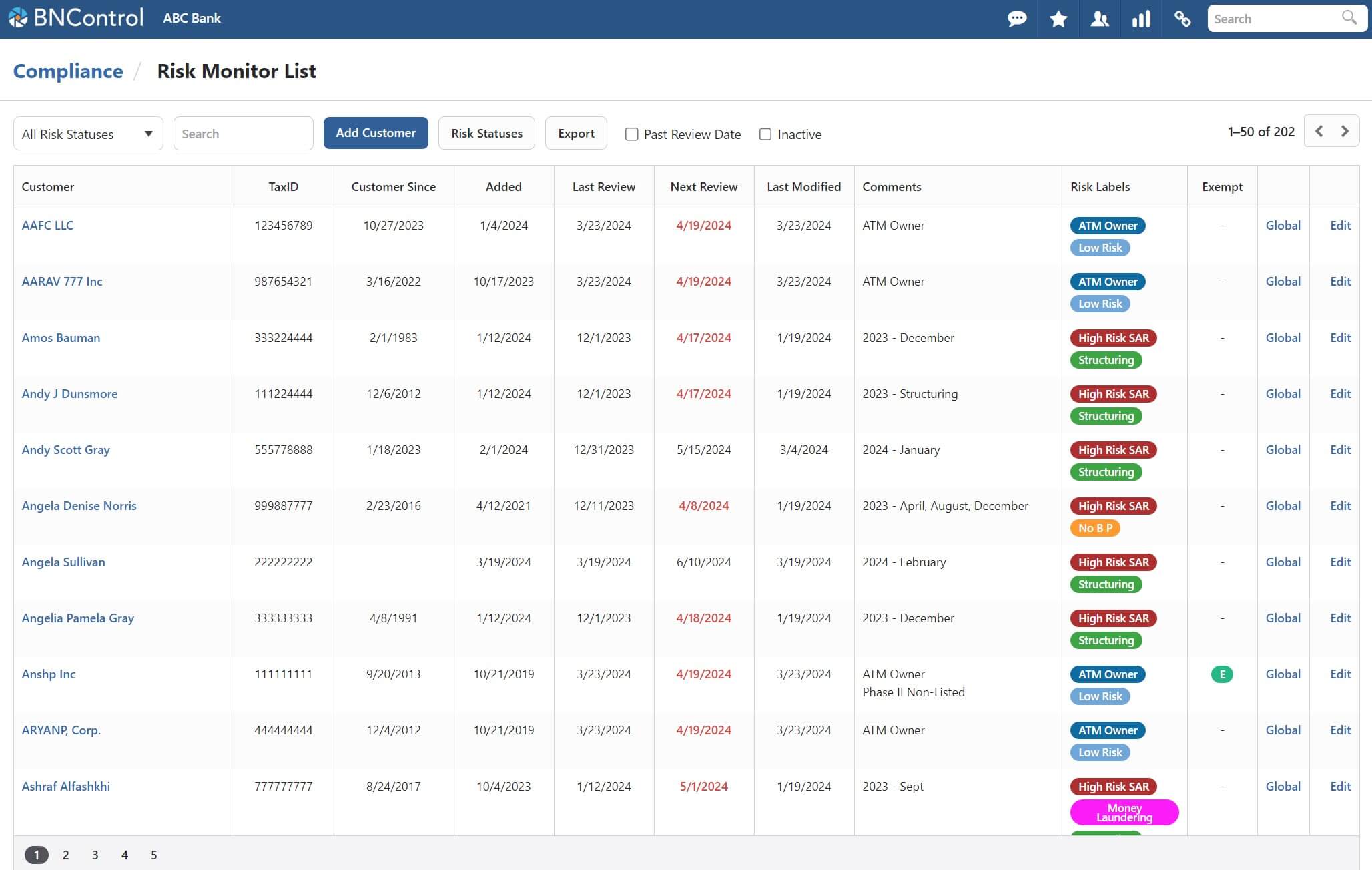

Risk Monitor List

The Risk Monitor List allows you to create a custom list of account holders who are tracked or exempt for any variety of reasons. This can be useful for keeping track of high-risk clients, or for clients who require special attention. The Risk Monitor List also allows you to track the last and next review date, ensuring that items are being reviewed regularly and that any potential risks are being identified and addressed.

- Create custom labels for customers

- Track exempt and risk statuses

- Track review dates

- Identify all risk rated customers on BSA reports

FACTA/Red Flag

Is your Red Flag program automated and easily tracked? BNControl provides a checklist review procedure and a system that monitors when a checklist should be completed for a customer. In addition to the checklist, it also provides a series of reports that help you comply with Red Flag rules.

- Transactions on inactive and dormant accounts

- Line of Credit transactions within the first 90 days

- Late payments made within the first 30/90 days

- Anomalous Account Usage, indicating possible identity theft

OFAC & 314(a) Scanning

Financial Institutions are required to scan customers and transactions to help identify customers involved in criminal activities. BNControl can help automate this process by scanning a variety of sources.

- Customers

- Bank Checks

- Wires

- ACHs - Incoming/Outgoing

- Custom Files

- Vendors

Are you ready for a demo?

There's nothing like seeing it for yourself and we're excited to show you how BNControl can benefit your organization in so many ways.